Welcome to Episode 14 of the Preferred Shares Podcast.

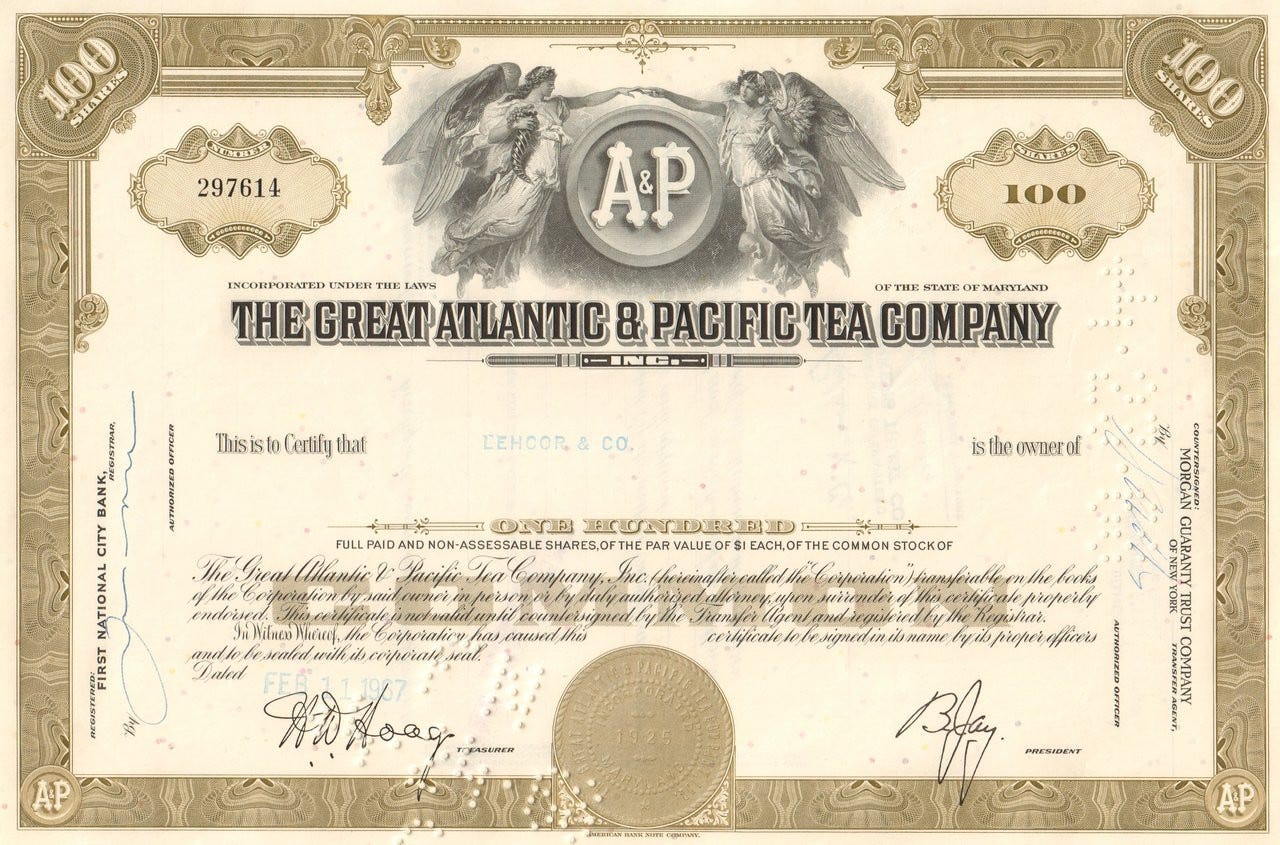

In this episode, Preferred Shares explores the evolution of grocery retailing in the United States with a focus on the rise of A&P, it becoming the largest retailer in the world, and the company’s ultimate demise. To help tell this story, there is no better expert than historian, author, and economist Marc Levinson, author of The Great A&P and the Struggle for Small Business in America. Levinson has authored several other books, including The Box: How the Shipping Container Made the World Smaller and the World Economy Bigger, and has contributed to reputable publications such as Time magazine, The Economist, Newsweek magazine, and Harvard Business Review.

In this episode

A&P tea distribution

The grocery retail landscape in the late 19th century

Spices, baking powder, and the rise of branded goods

Packaging innovations

Wholesaler influence and control over grocers

Kroger, Albertsons, and Grand Union all began as tea companies

Perishable vs stable goods

Early store dimensions - 20 ft x 25 ft

Manufacturer-set pricing, markups and ‘fair pricing’

Chain stores gaining bargaining power

A&P Economy stores - bare-bones, limited selection, rock-bottom prices

Rethinking profitability, inventory turnover, margins versus returns

A&P’s vertical integration efforts, including dairies, canneries, macaroni and cocoa factories, and more

Scaling bargaining power

What does ‘fair price’ mean? The counterargument that discounting is actually harmful to consumers over the long run

Advantages of private company vs. being public

Long-term perspective

State and federal efforts aiming to crush chain stores

Fixed prices, scaling chain taxes, and targeted restrictions

Weighing regulation and innovation

Anti-trust case against A&P

Pressures closing A&P’s discount gap and eroding its reputation

Strain from a lack of distinct succession plan and ability to adapt

Pressures from being public to produce dividends rather than reinvest and reinvigorate the business

Our post-interview discussion

Episode Resources

The Great A&P and the Struggle for Small Business in America, Second Edition

“When Washington Bailed Out Mom and Pop” – Marc Levinson discusses his book on December 15, 2011, at an event hosted by the Library of Congress.

“How The A&P Changed The Way We Shop” – Marc Levinson discusses his book on August 23, 2011, on NPR’s Fresh Air show.

“The Great A&P and the Struggle for the Soul of Antitrust”, 98 Iowa Law Review Bulletin 55 (2013).

Additional Reading

Curious to see what else we’ve been working on? Below are some pieces we’ve written independently that we think you’d like:

Book Review: The Great A&P and the Struggle for Small Business in America by Marc Levinson, Lawrence Hamtil, 4/1/2021

“Excising the Old”, Part III in a three-part series on IBM’s electric typewriter and computer printer division, Douglas Ott, 10/6/2024

Enjoy this episode? Share it with someone who loves business history as much as you do!

You can also follow Preferred Shares, Devin, Doug, and Lawrence on Twitter.

Disclaimer

All opinions expressed by Preferred Shares hosts and guests are solely their own opinions and do not reflect the opinions of their respective employers. This podcast is for informational and entertainment purposes only and should not be relied upon as a basis for investment decisions. None of the information contained in the podcast or this web site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

Clients of Andvari and Fortune Financial may maintain positions in the securities discussed in this podcast. Furthermore, from time to time, the Hosts may hold positions or other interests in securities mentioned in the Podcast and may trade for their own accounts based on the information presented. The Hosts may also take positions inconsistent with the views expressed in its messages on the Podcast.