Welcome to Episode 18.

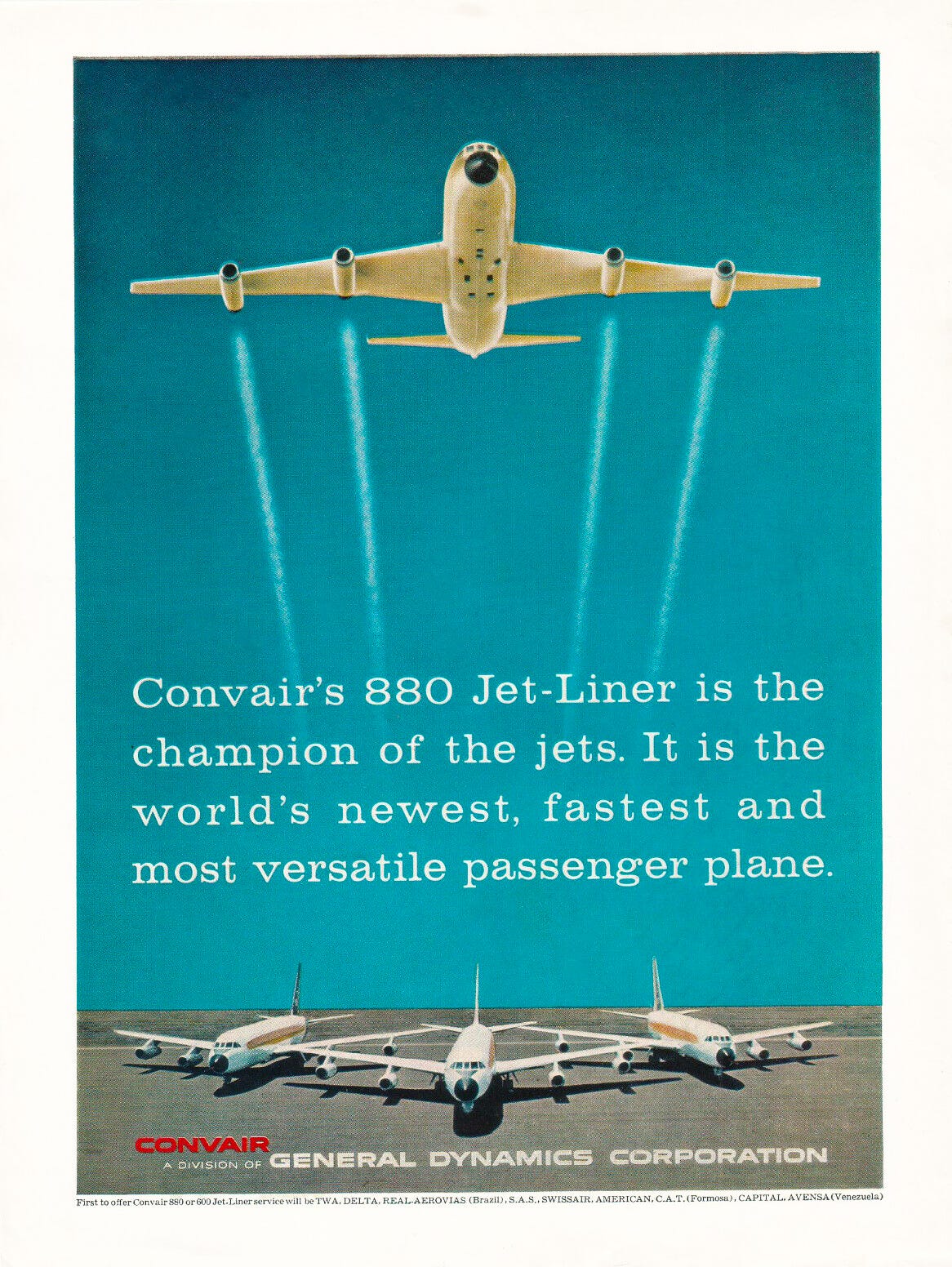

In this episode, Doug picks up the story from where we left off in Part 1: its November 1941, when Consolidated Aircraft founder Reuben Fleet decides to sell his personal stake in the company. Doug then shares how Consolidated became Convair, was then acquired by General Dynamics, its disastrous foray into the commercial jetliner market, and its eventual demise in the mid-1990s.

In This Episode

(01:26) Reuben Fleet and his decision to sell Consolidated Aircraft.

(03:43) Fleet sells his entire personal stake in 1941.

(07:53) In 1943, Consolidated merges with Vultee Aircraft and becomes Convair.

(09:51) Reasons behind the sale.

(13:01) Rapid growth and decline of the aviation industry during and after World War II.

(14:50) Floyd Odlum and Atlas Corporation acquire a significant stake in Convair.

(16:04) Convair’s success in the 1950s.

(17:40) The B-36 bomber's development during World War II and its features, including its long-range capabilities and large crew, are described.

(20:01) General Dynamics acquires Convair in a two-step process.

(25:56) Convair gambles with Howard Hughes and the development of the Convair 880 jetliner.

Hughes runs into financial trouble and causes delays.

Convair eventually declares the largest losses in business history in the early 1960s due to its failed efforts in the commercial jetliner business.

(37:51) Henry Crown takes charge of General Dynamics to address losses from the Convair program.

(38:35) Convair shifts focus and becomes a subcontractor for the big commercial jetliners and also concentrates on its rocket and missile businesses.

(39:56) The defense industry consolidation in the post-Cold War era.

(42:21) General Dynamics sells off pieces of its Convair business and eventually shuts it all down.

(53:06) Reflection on Convair’s decline.

(57:42) The difficulty for defense companies trying to venture into the commercial space.

(65:14) Upcoming episodes.

Resources

Periodicals

General Dynamics World

Articles

“So They Named It General Dynamics”, Fortune, April 1953.

“BOARDS APPROVE CONVAIR MERGER; General Dynamics to Step Up as Vast Defense Complex if Stockholders Concur”, NYT, March 2, 1954.

“Intercontinental Rocket Reported Being Built”, NYT, Dec. 16, 1954.

“SUPERSONIC B-58 FLIES FIRST TIME”, NYT, Nov. 12, 1956.

“American Raises Jet order by 50”, NYT, 7/31/1958.

“New Jet Passes Operation Tests; Convair 880 to Begin Flying Commercial Routes for Delta Line on May 15”, NYT, May 2, 1960.

“Jet Purchase Plan of TWA Approved”, NYT, June 25, 1960.

“CONVAIRS SLATED FOR T.W.A. LEASED; Northeast to Use Six Jets Idle Because of Hughes' Financial Problems”, NYT, Nov. 23, 1960.

“The Plane Makers Under Stress”, Forbes, June 1960.

“Defense Supplier Posts Loss for ‘60”, NYT, March 24, 1961.

Smith, Richard Austin. “How a Great Corporation Got Out of Control: Part 1”, Fortune, January 1962.

Smith, Richard Austin. “How a Great Corporation Got Out of Control: Part 2”, Fortune, February 1962.

“Lewis of Dynamics”, Fortune, March 1962.

Books

Sweetman, William. A History of Passenger Aircraft. London: Hamlyn Publishing, 1979.

Steele, James B. Howard Hughes: His Life and Madness. New York: W.W. Norton, 1979

Videos and Podcasts

Henry Crown and Material Service Corporation

This is the story of how Henry Crown built a large aggregates business from scratch and parlayed it into 20% control of General Dynamics.

“The Story of Willow Run” — Building the B-24 bomber during WWII

CONVAIR B-36 - Story of the Strategic Air Command's Masive Cold War Peacemaker!

“ON TARGET: THE ATLAS ICBM” — 1958 Convair Astronautics SM-65B Missile Launch documentary

Additional Reading

Doug (Andvari’s Substack) writes more about Reuben Fleet in his post “Quality Over Quantity”, published December 2024.

Doug (Andvari’s Substack) also wrote Victor Emanuel of Aviation Corporation in his post “Victor Emanuel: Part 1, From Gilded Age Dealmaker to Turnaround Artist”, published January 26, 2025.

Devin (Invariant Substack) writes about the FY2024 results of Philip Morris in “Philip Morris International: Conquest”.

Lawrence (Fortune Financial) writes about “Exploring the Surprising Resilience of the Defense Industry”.

Enjoy this episode? Share it with someone who loves business history as much as you do!

You can also follow Preferred Shares, Devin, Doug, and Lawrence on Twitter.

Disclaimer

All opinions expressed by Preferred Shares hosts and guests are solely their own opinions and do not reflect the opinions of their respective employers. This podcast is for informational and entertainment purposes only and should not be relied upon as a basis for investment decisions. None of the information contained in the podcast or this web site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

Clients of Andvari and Fortune Financial may maintain positions in the securities discussed in this podcast. Lawrence Hamtil and clients of Fortune Financial owned the securities of Lockheed Martin and Martin Marietta at the time of this publication. Furthermore, from time to time, the Hosts may hold positions or other interests in securities mentioned in the Podcast and may trade for their own accounts based on the information presented. The Hosts may also take positions inconsistent with the views expressed in its messages on the Podcast.