Welcome to Episode 20 of the Preferred Shares Podcast.

We interviewed a special guest, Mark Purdy, about Lindt & Sprüngli, a Swiss chocolatier founded 180 years ago in 1845. Mark is a veteran investment analyst with a focus on consumer brands for the last forty years and is currently Portfolio Manager at Chelverton Asset Management’s Select Consumer Staples Fund.

In This Episode

Here are some highlights from the interview with Mark Purdy about Lindt:

01:27 - Mark Purdy’s Background in Consumer Staples

05:01 - Investment Metrics for Consumer Staples

06:47 - Lindt’s Historical Success and Sales Growth

10:37 - Lindt’s Premium Positioning and Market Strategy

13:18 - Market Share Potential in the U.S. and Europe

16:23 - Lindt’s Unique Retail Strategy and Store Performance

19:12 - Sales Distribution Channels and Profitability

22:30 - Acquisition Strategy and Capital Allocation

25:22 - Buybacks and Dividend Policy

29:37 - Long-Term Value and Consumer Staples Resilience

33:31 - Economic Sensitivity and Market Performance

36:22 - Navigating Economic Challenges: A Long-Term Perspective

41:30 - Quality Over Short-Termism: The Lindt Philosophy

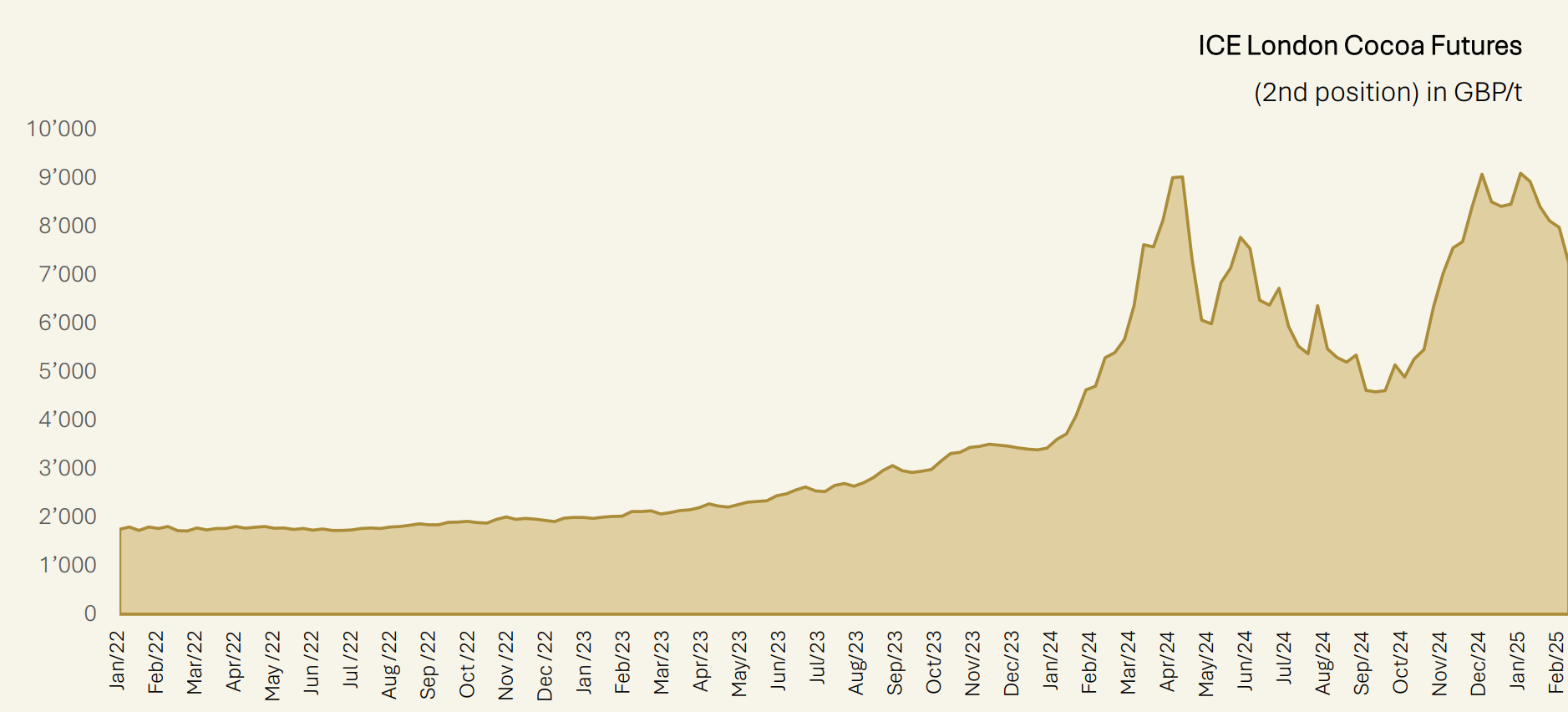

44:20 - Cocoa Prices and Market Dynamics

49:59 - Consumer Behavior and Premium Chocolate

57:31 - Future Risks and Growth Opportunities for Lindt

Additional Reading & Listening

Curious to see what else we’ve been working on? Check out some of the interesting things we’ve done recently:

Douglas Ott (Andvari Associates and @yesandnotyes) has been writing about the history of Booz Allen Hamilton as well as the recent board shake-up at CoStar Group

Lawrence Hamtil (Fortune Financial and @lhamtil)

Devin LaSarre (Invariant and @DevinLaSarre) continues his coverage of several tobacco businesses and also wrote a retrospective on the brand mismanagement of Schlitz beer

Enjoy this episode? Share it with someone who loves business history as much as you do!

You can also follow Preferred Shares, Devin, Doug, and Lawrence on Twitter.

Disclaimer

All opinions expressed by Preferred Shares hosts and guests are solely their own opinions and do not reflect the opinions of their respective employers. This podcast is for informational and entertainment purposes only and should not be relied upon as a basis for investment decisions. None of the information contained in the podcast or this web site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

Clients of Andvari and Fortune Financial may maintain positions in the securities discussed in this podcast. Furthermore, from time to time, the Hosts may hold positions or other interests in securities mentioned in the Podcast and may trade for their own accounts based on the information presented. The Hosts may also take positions inconsistent with the views expressed in its messages on the Podcast.